“We are not taking this lightly, obviously, because Canadians across the country are worried about it.”

The words of Justin Trudeau, Canada’s Prime Minister, as he spoke to reporters after visiting a manufacturer in Quebec today (22 August), the day an unprecedented freight stoppage on the country’s railways began, threatening to upend supply chains and rock the economy.

"We will have more to say shortly on what we're doing to make sure the right solution is found, quickly, for the economy," Trudeau was quoted as saying in media reports, without providing further details.

What’s happened and why?

Freight services have ground to a halt after a midnight (EST) deadline passed without agreement between rail companies Canadian National Railway Co. (CN) and Canadian Pacific Kansas City (CPKC) and union officials over working conditions.

The shutdown is different from a strike in that engineering and conducting staff for the two companies – which have a duopoly on freight traffic in Canada – have been locked out.

The stoppage comes after Canada’s federal government changed rules on shifts and rest periods, issues now at the heart of the disagreement between the railway companies and unions.

Yesterday, as the deadline for an agreement loomed, Trudeau urged both sides to continue to reach for a deal.

Business groups have demanded Canada’s federal government steps in and insists on formal arbitration. CN claims it “offered to voluntarily submit to binding arbitration in June” but says the Teamsters Canada Rail Conference union representing staff refused.

The railway operators and unions have accused the other of not embarking on negotiations seriously, with both sides blaming each other for the shutdown.

In a statement issued just after midnight local time, CN said it had “formally locked out” Teamsters Canada Rail Conference members after the union “did not respond to another offer by CN in a final attempt to avoid a labour disruption”.

“This offer improved wages and would have seen employees work less days in a month by aligning hours of service in the collective agreement with federally mandated rest provisions,” CN said. “The offer also proposed a pilot project for hourly rates and scheduled shifts on a portion of the network as CN continues to believe this is a better and more predictable framework for our employees.

“Over the last nine months, CN has negotiated in good faith. The company consistently proposed serious offers, with better pay, improved rest and more predictable schedules. The Teamsters have not shown any urgency or desire to reach a deal that is good for employees, the company and the economy.”

By contrast, Teamsters Canada Rail Conference said it had “put forward multiple offers, none of which were seriously considered by either company”.

“Throughout this process, CN and CPKC have shown themselves willing to compromise rail safety and tear families apart to earn an extra buck. The railroads don’t care about farmers, small businesses, supply chains, or their own employees. Their sole focus is boosting their bottom line, even if it means jeopardising the entire economy,” Paul Boucher, the union’s president, said in a statement earlier today.

Despite the lockout of staff, Teamsters said it “remains at the bargaining table with both companies”. Local media reports said discussions were set to resume today.

What impact has Canada rail shutdown already had?

Supply chains had already seen disruption as the deadline neared, business leaders say.

Michael Graydon, chief executive of trade body Food, Health & Consumer Products Canada (FHCP), told Just Food the movement of goods had wound down as the deadline for negotiations neared, saying the networks have “pretty much been on strike for a week. They’ve stopped shipping stuff”.

He added: “I think people have bought inventory in to be able to get them over a short- to medium-term hump but one of the things is we’ve got massive backlog at the ports because they stopped moving stuff or have been very selective in what they’re moving.”

Canada’s rail shutdown is, not incidentally, just focused on freight. All train movement on CKPC lines around cities including Vancouver and Toronto has stopped, hitting commuter services.

What impact might shutdown continue to have?

According to the Railway Association of Canada, some C$380bn ($279.6bn) of goods are moved on the country’s railways each year, ranging from cars to agri commodities and frozen foods.

Industry watchers have pointed to the specific impact of the rail shutdown on Canada's agri-food sector.

“Agriculture is one of the most affected industries, with about 95% of all grains being transported by rail. While trucks could temporarily cover some of the gaps, the higher costs and limited availability of trucks mean that they cannot fully compensate for the potential disruption,” Sylvain Charlebois, a professor of food policy and distribution at Dalhousie University, says. “Reports indicate that transportation costs are already rising for those buying or selling agricultural commodities.”

Graydon warned Canada’s agri-food sector faces weeks of disruption to supply chains from the rail shutdown, even if a speedy resolution, including government action, is found to break the impasse.

“I expect they will step in fairly quickly and force some binding arbitration on the process but who knows when that would be?” he said, speaking to this publication just hours before the deadline. “It’s going to take six weeks to get the supply chain back into normalcy.

“You’ve got tons of inventory that people have moved into places in hopes that it’s not too long and we can satisfy the consumer demand for products. Everything is a bit disrupted and it’ll take a little time to iron out. Fingers crossed, it either gets resolved or government steps in and resolves it for them.”

With Canada’s food manufacturing base principally in the “Ontario, Quebec corridor”, Graydon said, FHCP’s members rely on rail to ship most of the production to the west of the country.

“For them, we’re looking at for every week close to C$40m in lost sales with the inability to ship and do that,” he said.

Manufacturers are also set to face disruption to their supplies of inputs, including agri commodities.

“The other side of it is, if it’s any longer-term work stoppage, both the Port of Vancouver and the Port of Montreal are the input ports for an awful lot of the ingredients utilised in manufacturing of consumer goods and consumer packaged goods and our consumer health products,” Graydon said. “It’s going to put a strain on manufacturing capacity, with shortages of ingredients to be able to complete the manufacturing process.

Asked when the impact of the rail shutdown may start to be seen on store shelves or on menus in Canada, Graydon suggested “probably two weeks”.

He added: “The other challenge is this is getting a lot of media in Canada right now and so what you end up with – very similar to what happened during Covid – is you get consumer hoarding and so the inventory strain is quite significant. It’s really hard to manage that. That will put a bit of a strain on it, too, and maybe deplete them towards a little bit faster in some key categories but it will have to see.”

At financial services group Moody’s, economists have calculated what they think the potential wider impact of the rail shutdown could be on Canada’s economy.

“Based on our analysis, completely shutting down 75% of Canada’s freight rail traffic would cost the economy up to a whopping C$341m per day, a rate equal to more than 4% of the nation’s GDP. These figures may seem high but Canada’s fertiliser industry recently announced that the strike could cost it up to C$63m per day alone,” Brendan LaCerda, director of economic research at Moody’s, said, noting the firm estimated the loss to Canada’s fertiliser sector to be slightly higher, at C$68m a day.

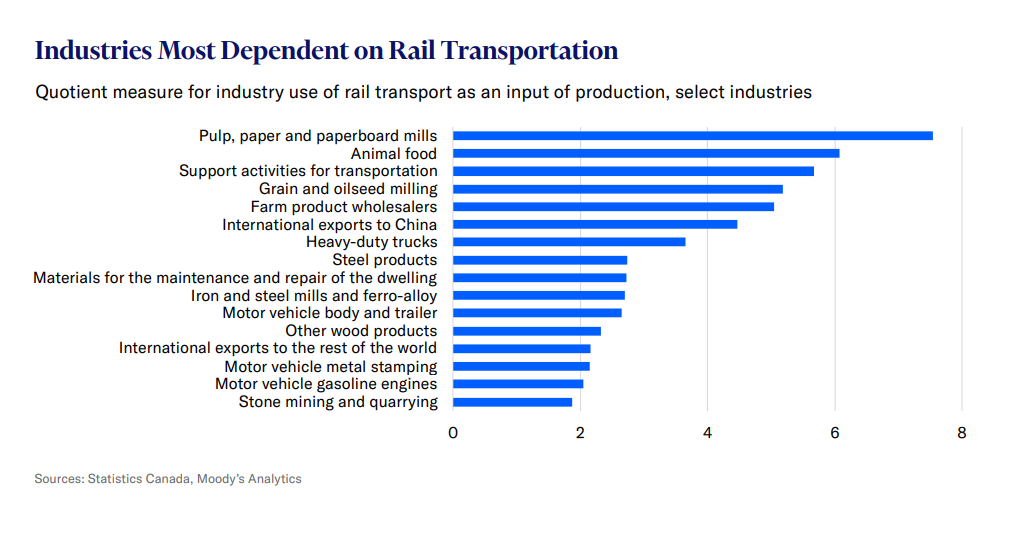

In a note to investors issued yesterday ahead of the shutdown, LaCerda said he and his colleagues had sought to calculate how dependent individual industries in Canada are on rail transport. The team, he explained, computed “each industry’s use of rail transportation as a share of the value of its final product” and then took a ratio of each of these shares to the average total share.

“This quotient,” he said, “measures the relative importance of rail transport across industries.” Moody’s gave animal-food manufacturing a 6.1%, “implying that rail transport’s contribution to animal food production, measured as a share of animal food’s total revenue, is six times greater than motor-vehicle brake-system manufacturing, which has a value of one”.

LaCerda added: “By this measure, the industries hit hardest by a rail strike would be paper and wood products, agriculture and farming, exporters, motor vehicles, metals and quarrying.”

Grain Growers of Canada, which represents the country’s grain growers, says it estimates the initial impact of the rail shutdown will cost grain farmers more than C$43m a day in the first week alone. It says losses are expected to grow to C$50m a day the week after and beyond if the stoppages continue.

Kyle Larkin, executive director of Grain Growers of Canada, said: “This disruption is happening at the worst possible moment, during the start of harvest season, when our farmers are most dependent on our rail network.”

For now, all eyes will be on the result of today’s round of negotiations, if any. Business leaders will, of course, be hoping for a resolution.

At FHCP, Graydon says the Canadian government will be loath to intervene and demand arbitration but believes it’s “the only solution”.

“They can legislate them back to work, but I think, from a political perspective, binding arbitration provides you the opportunity to put an unbiased third-party person in the middle, it allows the facts to determine, then there's a created outcome, whatever the arbitration does, and then the contract gets signed for whatever period of time.”